To be a successful forex trader, you need to establish a trading risk profile and find an appropriate broker. You also need to set your trading goals.

Establish a trading risk profile

Find an Appropriate Broker

Set Your Trading Goals

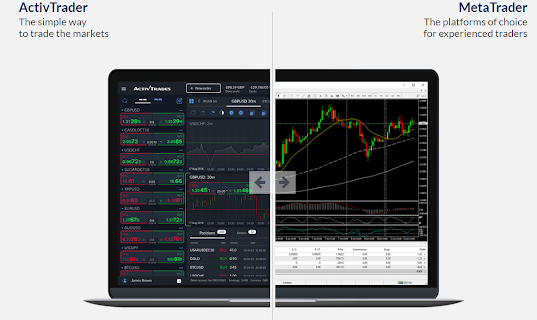

You need to use Trading tools to expand your knowledge. The forex market is constantly changing and forex traders need to be able to adapt to these changes quickly. One way to do this is by using online forex trading platforms. These platforms provide forex traders with real-time data and analysis tools that can help you make informed decisions about their trades.

Use Trading Tools To Expand Your Knowledge

Find the Right Trading Pairs e.g. EUR/GBP, EUR/JPY, EUR/CHF

Set up an Automated Trading System

In addition, forex traders should also find the right trading pairs for their strategies. For example, if you want to trade EUR/GBP, you should look for a platform that offers this pair. As a forex trader, you should set up an automated trading system as this will allow you to trade without having to constantly monitor the market.

Be A Constant Learner Through Webinars, Chart Patterns, and Monitoring Global Markets

Develop A Trading Plan

Control Your Emotions

Develop A Risk Management Strategy

Open a Demo Trading Account with ActivTrades

As a forex trader, it's important to be a constant learner. There are always new concepts to learn and new strategies to try. The best way to stay ahead of the curve is to participate in webinars, chart pattern studies, and global market monitoring. In addition, it's also crucial to develop a trading plan and control your emotions.

A well-rounded forex trader should also have a risk management strategy in place. One of the best ways to get started is to open a demo trading account. This will allow you to practice forex trading without putting any real money at risk. By taking these steps, you'll be well on your way to becoming a successful forex trader.

Practice Money Management Techniques

Cut Losses Early Than Later

Scale Positions

Have a Trading Journal

Be a Disciplined Trader

Open a Demo Trading Account with EightCap

Forex trading is all about managing your money. If you don't have a solid plan for how to manage your money, you will likely lose money in the long run. There are a few basic money management techniques that all forex traders should practice. First, always cut your losses early. It is better to take a small loss than to let a loss turn into a big one. Second, scale your positions.

Don't put all of your eggs in one basket. Third, keep a trading journal. This will help you track your progress and see what is working and what is not working. Fourth, be disciplined. Stick to your strategy and don't let emotions get in the way of your trading decisions. Finally, don't risk more than you can afford to lose.

Maintain a Healthy Work-Life Balance

Stay Updated With Forex News

Adapt To The Forex Market

Adapt A Technical Analysis Strategy

Trade Your Edge

Watch Other Markets

Forex trading can be a very lucrative occupation, but it is also one that can be very demanding. A forex trader needs to be able to sit for long hours in front of a computer screen, monitoring the market and looking for opportunities to buy or sell. This can take its toll on both your physical and mental health, so it is important to maintain a healthy work-life balance.

Make sure to take breaks often, and make time for other activities outside of forex trading. It is also important to stay up-to-date with forex news, as this can give you an edge over other traders. And finally, don't forget to develop a sound forex trading strategy. A good strategy will help you make consistent profits in the forex market.

Use Trading Tools To Expand Your Knowledge Find the Right Trading Pairs e.g. EUR/GBP, EUR/JPY, EUR/CHF Set an Automated Trading System

Open a Demo Trading Account with Alchemy Markets

Looking To Start Trading Forex?

Join our partners' FREE online forex trading sessions and share the experience and knowledge of finance professionals.

You can choose which educational trading webinars to participate in English, German, Italian, French, Spanish, Portuguese, Chinese, and Bulgarian:

Webinars are a great way to learn about the markets and get started with trading. Our team of experts will guide you through each step so that you can make informed decisions when it comes to your investments.

In our Forex Trading Education section traders can take advantage of Forex, CFD, and Crypto services like Expert Advisors EA's, reviews of Smart Trading Tools, Forex Video Lessons, Free Trading Webinars, One to One Training Forex education, and crypto trading and education.

Register now for FREE and gain access to upcoming webinars from our partners!

Watch the video Beginner Tips For a Successful Forex Trader

Disclaimer

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner's prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.