The dollar held near a one-week low versus major peers today as slumping U.S consumer confidence hurt bets for an early Federal Reserve tightening while disappointing Chinese economic data weakened the yuan and the Australian currency.

The dollar index, which measures the greenback against six rivals, was little changed at 92.561, having fallen 0.50% at the end of last week. It dipped as far as 109.335 yen for the first time since Aug. 4 on Monday, before trading 0.16% weaker at 109.42, as benchmark 10-year Treasury yields slid in the Asian session. Against the euro, the dollar was mostly flat at $1.1789, close to the one-week low of $1.18045 reached Friday.

A University of Michigan survey released at the end of last week showed consumer sentiment slid to the lowest level since 2011 amid an acceleration in COVID-19 infections.

U.S. retail sales data due Tuesday will be closely watched for further clues on consumer behavior. The dollar has oscillated with the flow of economic data, with momentum from a jobs market recovery pushing it to a four-month peak last week, only to see it knocked back by cooling inflation pressures. Net dollar long positions rose to their highest level since early March last year in the week ended Aug. 10.

Traders continue to look toward the Fed's central banking conference in Jackson Hole, Wyoming, toward the end of this month, for clues to its next move. Ahead of that, Fed Chair Jerome Powell holds a virtual town hall with educators and students on Tuesday. On Wednesday, the Fed releases minutes of its July policy meeting. Commonwealth Bank of Australia strategist Kim Mundy warns against making too much of the dip in consumer confidence and still predicts an announcement for a tapering of stimulus next month. One month's data does not make a trend but it bears watching.

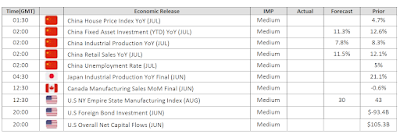

USD can lift this week if the FOMC minutes suggest committee members are considering tapering asset purchases as soon as next month. In Asia, the Australian dollar fell 0.54% to $0.7336 after economic data from its biggest trading partner, China, was disappointed, and as COVID- 19 lockdowns were tightened at home. China's factory output and retail sales growth slowed sharply in July, as new COVID-19 outbreaks and floods disrupted business operations, adding to signs the economic recovery is losing momentum.

Euro - EUR

The single currency traded higher on Friday as European Union exports to Britain rose in June after a volatile start to the country's first year outside the single market, while the bloc's exports to the rest of the world dropped slightly in the same month. Seasonally adjusted exports to Britain increased by 4.7% in June of the month. Overall, the EUR/USD traded with a low of 1.1722 and a high of 1.1747 before closing the day around 1.1728 in the New York session.

Yen - JPY

The Japanese Yen gained as slumping U.S consumer confidence hurt bets for an early Federal Reserve tightening while disappointing Chinese economic data weakened the yuan and the Australian currency. A University of Michigan survey released at the end of last week showed consumer sentiment slid to the lowest level since 2011. Overall, the USD/JPY traded with a low of 110.29 and a high of 110.2 before closing the day around 110.39 in the U.S session.

British Pound - GBP

The British Pound steadied against the dollar on Friday as the greenback weakened following a weak reading of consumer sentiment, but the British currency was still on track for the second week of declines. As of Aug 12, the pound was the third best-performing G10 currency, trailing the Canadian dollar and the U.S dollar. Overall, the GBP/USD traded with a low of 1.3793 and a high of 1.3876 before closing the day at 1.3806 in the New York session.

Canadian Dollar - CAD

The Canadian Dollar was little changed against its broadly weaker U.S counterpart on Friday, with news that Canadian Prime Minister Justin Trudeau is planning to call a snap election for Sept. 20 having little impact on the currency. With some 63% of its population fully vaccinated against COVID-19, Canada tops a ranking of major countries fighting the Pandemic. Overall, USD/CAD traded with a low of 1.2497 and a high of 1.2531 before closing the day at 1.2523 in the New York session.

Australian Dollar - AUD

The Australian Dollar fell as risk sentiment soured following disappointing Chinese economic data while fast-growing outbreaks of COVID-19 threaten Australia’s largest cities with longer lockdowns. Officials said the country’s second-most populous city of Melbourne would be put under curfew and Sydney reported record locally transmitted infections of the Delta variant of the virus. Overall, AUD/USD traded with a low of 0.7331 and a high of 0.7379 before closing the day at 0.7368 in the New York session.

###

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partners prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of futures performance.

No comments:

Post a Comment