Friday, 23 September 2022

TraderFactor Reviews Of Top Trusted Forex, Cfd, and Crypto Trading Brokers

We provide Financial Market Analysis, Trading Education, and Reviews of only Regulated and the most Trusted Forex, CFD, and Crypto brokers.

We provide Financial Market Analysis, Trading Education, and Reviews of only Regulated and the most Trusted Forex, CFD, and Crypto brokers.

Tuesday, 20 September 2022

Forex trading is a competitive field and EightCap also known as 8cap is competing with the best forex brokers out there

EightCap (8Cap) gives you access to trading 250+ Crypto Currencies including Crypto- crosses and Crypto-indices. It's a great FX broker to begin your journey into the world of online forex.

We provide Financial Market Analysis, Trading Education, and Reviews of only Regulated and the most Trusted Forex, CFD, and Crypto brokers.

We provide Financial Market Analysis, Trading Education, and Reviews of only Regulated and the most Trusted Forex, CFD, and Crypto brokers.

Tuesday, 28 June 2022

As a global leader in forex trading and investing

As a global leader in forex trading and investing, offering FX, indices, and commodities, ActivTrades has the best customer support system that's fully functional to meet industry standards.

You can expect a 27-minute email response time and experienced account representatives from ActivTrades.

Click here to get an edge with ActivTrades award-winning web-based platform and mobile apps.

Disclaimer: This information does not represent trading or investing advice!

We provide Financial Market Analysis, Trading Education, and Reviews of only Regulated and the most Trusted Forex, CFD, and Crypto brokers.

We provide Financial Market Analysis, Trading Education, and Reviews of only Regulated and the most Trusted Forex, CFD, and Crypto brokers.

Wednesday, 1 June 2022

Worries over a further acceleration in global inflation depressed investors

- The U.S. dollar strengthened across the board yesterday as Treasury yields climbed

- Fed Governor Christopher Waller said the Fed should be prepared to raise interest rates

- Euro remained weak as data showed eurozone inflation hit a record high in May

Forex market

U.S dollar strengthened across the board yesterday as Treasury yields climbed and worries over a further acceleration in global inflation depressed investors' risk appetite. The dollar was supported by demand for safe-havens.

U.S stocks fell yesterday as soaring oil prices and hawkish comments from a U.S Federal Reserve official spooked investors. U.S Treasury yields climbed on Tuesday, a day after Fed Governor Christopher Waller said the Fed should be prepared to raise interest rates by a half percentage point at every meeting from now on until inflation is decisively curbed.

The U.S Dollar Currency Index, which tracks the greenback against six other major currencies, was up 0.3% at 101.76, on pace for its best one-day gain in nearly two weeks. The dollar index, up about 6.4% for the year, is down 1.4% for May, on pace for its worst monthly loss in a year. President Joe Biden told Fed Chair Jerome Powell on Tuesday that he will give the central bank the space and independence to address inflation as it sees fit, according to a top aide.

Economic Calendar

Yesterday's bounce in the U.S dollar suggests better support for the dollar index around its 50-day moving average, which the index has been testing over the past couple of sessions. For now, the euro remained weak as data yesterday showed eurozone inflation hit a record high in May, adding pressure on the European Central Bank as it fends off a recession and looks to curb high prices with gradual interest rate increases in coming months.

Inflation in the 19 countries sharing the euro accelerated to 8.1% in May from 7.4% in April, beating expectations for 7.7% as price growth continued to broaden, indicating that it is no longer just energy pulling up the headline figure.

Euro-EUR

The single currency gave back some of its recent gains yesterday but was still set for its best month in a year as markets reposition in anticipation of interest rate increases in Europe and the possibility of a slower pace of U.S rate hikes. German inflation rose to its highest level in nearly half a century in May on the back of soaring energy and food prices. Overall, the EUR/USD traded with a low of 1.0469 and a high of 1.0563 before closing the day around 1.0497 in the New York session.

Japanese Yen-JPY

The Japanese Yen fell to a two-week low versus the U.S Dollar following higher Treasury yields as global inflation worries flared anew. The dollar index, which measures the currency against six major peers, including Japan's, rose 0.19% to 101.94, extending a 0.38% rally yesterday when data showed euro-area consumer inflation soaring to a record. Overall, the USD/JPY traded with a low of 128.32 and a high of 131.23 before closing the day around 130.82 in the U.S session.

British Pound-GBP

The British Pound fell against the Dollar but remained on track for its first monthly gain of 2022 even as Britain's murky growth outlook continued to weigh on sentiment. Despite the weakness, the sterling remains well off its mid-May lows when it touched its lowest level since March 2020. Sterling regained ground on the back of a strong labor market and CPI data. Overall, the GBP/USD traded with a low of 1.2409 and a high of 1.2568 before closing the day at 1.2455 in the New York session.

Canadian Dollar-CAD

The Canadian Dollar strengthened to its highest level in nearly six weeks against the greenback, boosted by recent strength in oil prices and domestic data that showed the economy had momentum heading into the second quarter. Canada's economy was not as robust as expected in the first quarter, growing at an annualized rate of 3.1%. Overall, USD/CAD traded with a low of 1.2788 and a high of 1.2877 before closing the day at 1.2805 in the New York session.

Australian Dollar-AUD

The Australian Dollar had a muted reaction to China’s PMI numbers after domestic building approvals data surprised to the downside. Chinese manufacturing PMI for May printed at 49.6 against 49.0 anticipated and the non-manufacturing came in at 47.8 instead of the 45.5 forecasts. Australian building approvals sunk -by 2.4% month-on-month in April. Overall, AUD/USD traded with a low of 0.6826 and a high of 0.6951 before closing the day at 0.6853 in the New York session.

Euro-Yen EUR/JPY

EUR/JPY is trading below 14, 50 and 100 days moving average. Fast stochastic is giving a bearish tone and MACD is also issuing a bearish stance. The Relative Strength Index is above 35 and lies below the neutral zone. In general, the pair has gained 1.25%.

Sterling-Yen GBP/JPY

Currently, GBP/JPY is trading below 14, 50 and 100 days moving average. Fast stochastic is issuing a bearish tone and MACD is also indicating a bearish stance. The Relative Strength Index is above 33 reading and lies below the neutral zone. On the whole, the pair has gained 1.16%.

Aussie-Yen AUD/JPY

Currently, the cross is trading above 14, 50 and 100 days moving average. Fast stochastic is giving a bearish tone and MACD is also indicating a bearish stance. The Relative Strength Index is above 36 reading and lies below the neutral region. In general, the pair has gained 1.45%.

Euro-Sterling EUR/GBP

This cross is currently trading above 14, 50 and below 100 days moving average. Fast stochastic is indicating a bullish tone and MACD is also issuing a bullish signal. The Relative Strength Index is above 58 and lies above the neutral region. Overall, the pair has gained 0.12%.

Sterling-Swiss GBP/CHF

This cross is trading below 14, 50 and 100 days moving average. Fast stochastic is issuing a bearish stance and MACD is also indicating a bearish tone. The Relative Strength Index is above 50 and lies below the neutral region. In general, the pair has lost 0.42%.

###

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner's prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.

We provide Financial Market Analysis, Trading Education, and Reviews of only Regulated and the most Trusted Forex, CFD, and Crypto brokers.

We provide Financial Market Analysis, Trading Education, and Reviews of only Regulated and the most Trusted Forex, CFD, and Crypto brokers.

Tuesday, 31 May 2022

Inflation data from Germany and Spain yesterday showed price rises accelerated in May

- The U.S dollar resumed its slide as risk appetite across markets tentatively strengthened

- Trade was light as U.S stock and bond markets were closed for the Memorial Day public holiday

- Data on Friday showed that U.S consumer spending rose more than expected

Forex market

The U.S dollar resumed its slide yesterday as risk appetite across markets tentatively strengthened, supported by encouraging economic data and bets that the Federal Reserve will tighten policy at a slower pace. The dollar index - which tracks the greenback against six major rivals - is on track for its first monthly drop in five, as the safe-haven currency loses steam after a breakneck start to the year.

The dollar index is on track for a more than 1.5% drop in May - although it remains up about 6% on the year. Trade was light as U.S stock and bond markets close for the Memorial Day public holiday. Data on Friday showed that U.S consumer spending rose more than expected in April as households boosted purchases of goods and services, and the rise in inflation slowed. Analysts said the encouraging data, coupled with bets on a more cautious tightening path by the Fed, was weakening the dollar.

World share markets rose on Monday as easing COVID-19 restrictions and new stimulus in China helped sustain last week's rebound. How the US consumer plays out from here and from a global perspective how the Chinese economy performs will be crucial determinants for broader investor risk appetite. A slew of further economic data is due this week which could give clues on the outlook for global growth, including U.S. jobs numbers and Chinese Purchasing Managers' Index figures.

Economic Calendar

Inflation data from Germany and Spain showed price rises accelerated in May, pushed up by soaring energy prices, ahead of eurozone inflation figures today. The inflation numbers helped keep a lid on the euro's gains. The safe-haven yen fell back 0.5% and the Sterling edged up 0.1%.

Euro-EUR

The single currency traded higher as the U.S dollar resumed its slide yesterday as risk appetite across markets tentatively strengthened, supported by encouraging economic data and bets that the Federal Reserve will tighten policy at a slower pace. Trade was light as U.S stock markets were closed for the Memorial Day public holiday. Overall, the EUR/USD traded with a low of 1.0469 and a high of 1.0563 before closing the day around 1.0497 in the New York session.

ActivTrades Education Section

Japanese Yen-JPY

The Japanese Yen steadied as the bank of Japan Governor Haruhiko Kuroda pledged to patiently stick to powerful monetary easing to help the economy recover from the COVID-19-induced doldrums, shrugging off any suggestion about a departure from its stimulus policy. Kuroda told parliament the yen was regaining stability after its recent rapid weakening. Overall, the USD/JPY traded with a low of 128.32 and a high of 131.23 before closing the day around 130.82 in the U.S session.

British Pound-GBP

The British Pound edged higher against a faltering U.S dollar yesterday and was set for its first monthly gain in five as the risk-sensitive currency benefited from improving sentiment. As markets have readjusted their rate hike expectations from the Federal Reserve lower, the dollar index has weakened over 3.5% from its mid-May peak. Overall, the GBP/USD traded with a low of 1.2409 and a high of 1.2568 before closing the day at 1.2455 in the New York session.

Canadian Dollar-CAD

The Canadian Dollar rose to its highest level in more than five weeks against the greenback in yesterday’s session, as data showed Canada's current account surplus turning positive and ahead of an expected interest rate hike this week by the Bank of Canada. Canada's current account surplus was C$5.0 billion in the first quarter. Overall, USD/CAD traded with a low of 1.2788 and a high of 1.2877 before closing the day at 1.2805 in the New York session.

ActivTrades Trading Accounts

Australian Dollar-AUD

The Australian Dollar extended a two-week rally yesterday as investors cut back on long positions in the U.S dollar ahead of a packed schedule of major local and offshore economic data. The rally owes much to a pullback in the U.S dollar and speculation the Federal Reserve will go slower once it has hiked by 100 basis points over the next two months. Overall, AUD/USD traded with a low of 0.6826 and a high of 0.6951 before closing the day at 0.6853 in the New York session.

Euro-Yen EUR/JPY

EUR/JPY is trading below 14, 50 and 100 days moving average. Fast stochastic is giving a bearish tone and MACD is also issuing a bearish stance. The Relative Strength Index is above 35 and lies below the neutral zone. In general, the pair has gained 1.25%.

Sterling-Yen GBP/JPY

Currently, GBP/JPY is trading below 14, 50 and 100 days moving average. Fast stochastic is issuing a bearish tone and MACD is also indicating a bearish stance. The Relative Strength Index is above 33 reading and lies below the neutral zone. On the whole, the pair has gained 1.16%.

Aussie-Yen AUD/JPY

Currently, the cross is trading above 14, 50 and 100 days moving average. Fast stochastic is giving a bearish tone and MACD is also indicating a bearish stance. The Relative Strength Index is above 36 reading and lies below the neutral region. In general, the pair has gained 1.45%.

Euro-Sterling EUR/GBP

This cross is currently trading above 14, 50 and below 100 days moving average. Fast stochastic is indicating a bullish tone and MACD is also issuing a bullish signal. The Relative Strength Index is above 58 and lies above the neutral region. Overall, the pair has gained 0.12%.

Sterling-Swiss GBP/CHF

This cross is trading below 14, 50 and 100 days moving average. Fast stochastic is issuing a bearish stance and MACD is also indicating a bearish tone. The Relative Strength Index is above 50 and lies below the neutral region. In general, the pair has lost 0.42%.

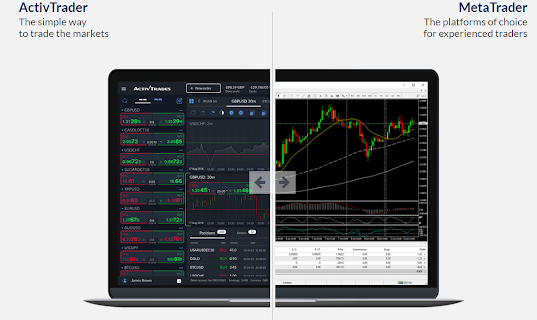

ActivTrades Trading Platforms

###

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner's prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.

We provide Financial Market Analysis, Trading Education, and Reviews of only Regulated and the most Trusted Forex, CFD, and Crypto brokers.

We provide Financial Market Analysis, Trading Education, and Reviews of only Regulated and the most Trusted Forex, CFD, and Crypto brokers.

Thursday, 26 May 2022

Australian business investment fell unexpectedly in the first quarter

- Minutes from the Federal Reserve's May meeting confirmed the potential for a pause in rate hikes

- Sterling was flat against the dollar and rose against the euro yesterday

- The Canadian dollar edged higher yesterday, recovering from its lowest level in nearly a week

Forex market

The dollar hovered near a one-month low today as minutes from the Federal Reserve's May meeting confirmed the potential for a pause in rate hikes after likely further increases in June and July. The dollar index - which measures the currency against six major peers - edged 0.1% higher to 102.15 as a decline in Asian equities fostered demand for safe havens like the greenback.

However, the index has mostly been consolidating around 102 after a short-lived bounce to 102.45 immediately following Wednesday's release of the minutes. Analysts said there was nothing to suggest a further ramp-up of the Federal Open Market Committee's already hawkish stance. Wall Street rallied overnight on that outlook, while long-term Treasury yields held steady. Atlanta Fed President Raphael Bostic had already suggested earlier this week that a pause might be the best course of action in September to monitor the effects on the economy following two more 50-basis-point hikes in June and July.

Economic Calendar

The dollar index reached a nearly two-decade peak above 105 mid-month. Still, signs that aggressive Fed action may already be slowing economic growth have prompted traders to scale back tightening bets, with Treasury yields also dropping from multiyear highs. The 10-year Treasury yield tracked sideways in Tokyo at 2.75%, continuing its consolidation around that level this week. A soft DXY backdrop is forming although it's still too early to call a long-term DXY peak. The dollar added 0.08% to 127.425 yen, while the euro was about flat at $1.0679.

Sterling slipped 0.17% to $1.25615. The risk-sensitive Aussie sank 0.25% to $0.70695. The New Zealand dollar dropped 0.31% to $0.6458, after shedding most of the gains following Wednesday's hawkish Reserve Bank of New Zealand meeting outcome, which had lifted it to a three-week top of $0.6514. The dollar's safe-haven appeal should keep it bid going forward.

Crypto Exchanges Reviews

Euro-EUR

The single currency gained as the dollar hovered near a one-month low today as minutes from the Federal Reserve's May meeting confirmed the potential for a pause in rate hikes after likely further increases in June and July. There was nothing to suggest a further ramp up of the Federal Open Market Committee's already hawkish stance. Overall, the EUR/USD traded with a low of 1.0469 and a high of 1.0563 before closing the day around 1.0497 in the New York session.

Japanese Yen-JPY

The Japanese Yen steadied as the dollar index which measures the currency against six major peers edged 0.1% higher to 102.15 as a decline in Asian equities fostered demand for safe havens like the greenback. However, the index has mostly been consolidating around 102 after a short-lived bounce following a release of the minutes. Overall, the USD/JPY traded with a low of 128.32 and a high of 131.23 before closing the day around 130.82 in the U.S session.

British Pound-GBP

The British Pound was flat against the dollar and rose against the euro, having briefly lost ground against both currencies following the publication of a report detailing COVID lockdown-breaching parties at the office of Britain's prime minister. A failure of leadership was to blame for a culture that led to the alcohol-fueled gatherings being held. Overall, the GBP/USD traded with a low of 1.2409 and a high of 1.2568 before closing the day at 1.2455 in the New York session.

Crypto Wallets Reviews

Canadian Dollar-CAD

The Canadian Dollar edged higher against its U.S counterpart yesterday, recovering from its lowest level in nearly a week, as equity markets rallied after the U.S Federal Reserve released minutes of its latest policy meeting. U.S crude oil futures settled 0.5% higher at $110.33 a barrel, buoyed by tight supplies. Overall, USD/CAD traded with a low of 1.2788 and a high of 1.2877 before closing the day at 1.2805 in the New York session.

Australian Dollar-AUD

The Australian Dollar traded lower as Australian business investment fell unexpectedly in the first quarter as floods and bottlenecks hit building work, though firms sharply lifted plans for spending in the year ahead in a boost to the economic outlook. Data from the Australian Bureau of Statistics out on Thursday showed private capital spending dipped a real 0.9% in the March quarter. Overall, AUD/USD traded with a low of 0.6826 and a high of 0.6951 before closing the day at 0.6853 in the New York session.

Euro-Yen EUR/JPY

EUR/JPY is trading below 14, 50 and 100 days moving average. Fast stochastic is giving a bearish tone and MACD is also issuing a bearish stance. The Relative Strength Index is above 35 and lies below the neutral zone. In general, the pair has gained 1.25%.

Sterling-Yen GBP/JPY

Currently, GBP/JPY is trading below 14, 50 and 100 days moving average. Fast stochastic is issuing a bearish tone and MACD is also indicating a bearish stance. The Relative Strength Index is above 33 reading and lies below the neutral zone. On the whole, the pair has gained 1.16%.

Aussie-Yen AUD/JPY

Currently, the cross is trading above 14, 50 and 100 days moving average. Fast stochastic is giving a bearish tone and MACD is also indicating a bearish stance. The Relative Strength Index is above 36 reading and lies below the neutral region. In general, the pair has gained 1.45%.

Euro-Sterling EUR/GBP

This cross is currently trading above 14, 50 and below 100 days moving average. Fast stochastic is indicating a bullish tone and MACD is also issuing a bullish signal. The Relative Strength Index is above 58 and lies above the neutral region. Overall, the pair has gained 0.12%.

Sterling-Swiss GBP/CHF

This cross is trading below 14, 50 and 100 days moving average. Fast stochastic is issuing a bearish stance and MACD is also indicating a bearish tone. The Relative Strength Index is above 50 and lies below the neutral region. In general, the pair has lost 0.42%.

Forex Brokers Reviews

###

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner's prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.

We provide Financial Market Analysis, Trading Education, and Reviews of only Regulated and the most Trusted Forex, CFD, and Crypto brokers.

We provide Financial Market Analysis, Trading Education, and Reviews of only Regulated and the most Trusted Forex, CFD, and Crypto brokers.