Are you tired of losing money to fees before you even make a trade?

Every forex trader knows that trading costs matter. When you buy or sell currency, you want to keep as much profit as possible. High commissions and big spreads can eat up your earnings fast.

That is why finding a broker with low costs is so important. M4 Markets is a broker that focuses on keeping your expenses down. They offer low spreads, clear fees, and different account types to fit your budget.

In this guide, we will look at how M4 Markets helps you save money on every trade. We will explore their account types, their fee structure, and why they are a good choice for cost-conscious traders.

Why Low Trading Costs Are Vital for Your Success

When you trade forex, you are running a small business. Like any business, you have expenses. If your expenses are too high, it is hard to make a profit.

The Impact of Spreads on Profit

The “spread” is the difference between the buy price and the sell price. Think of it as a small fee built into every trade.

If the spread is high (or “wide”), the market has to move more in your favor before you start making money. If the spread is low (or “tight”), you can start seeing profit sooner.

M4 Markets offers spreads starting from 0.0 pips on some accounts. This means the cost to enter a trade is very low. This is great for traders who make many trades in a day.

Avoiding Hidden Fees

Some brokers have fees that you do not see right away. These can include:

- Deposit fees

- Withdrawal fees

- Inactivity fees

These small costs add up over time. A good broker is transparent. This means they tell you exactly what you will pay. M4 Markets prides itself on being clear about costs. They do not charge deposit or withdrawal fees for most payment methods. This keeps more money in your account for trading.

Understanding M4 Markets Account Types

M4 Markets knows that every trader is different. Some are new and trade with small amounts. Others are experts who trade big volumes. They offer three main account types to help you manage costs in the way that suits you best.

The Standard Account for Beginners

If you are new to trading, the Standard Account is a great place to start. It is designed to be simple and low-cost for small trades.

No Commission Fees

With the Standard Account, you do not pay a separate commission fee for each trade. The cost is built into the spread. This makes it easy to calculate your profit and loss. You do not need to do complex math to figure out your fees.

Low Minimum Deposit

You can start with just $5. This is very low compared to many other brokers. It allows you to test the waters without risking a lot of money. The spreads start from 1.1 pips, which is competitive for a commission-free account.

The Raw Spread Account for Serious Traders

If you trade often, the Raw Spread Account might be better for you. This account is built for traders who want the tightest possible spreads.

Spreads from 0.0 Pips

On this account, spreads can go as low as zero. This means you get the direct market price. This is perfect for strategies like “scalping,” where you make many small trades quickly.

Low Commission per Lot

Because the spreads are so low, M4 Markets charges a small commission on this account. The fee is $3.50 per lot per side. This is lower than the industry standard. Even with this fee, the total cost is often lower than a Standard Account if you trade heavily.

The Premium Account for Professionals

For traders with larger balances, the Premium Account offers the best conditions.

Lowest Costs for High Volume

This account requires a minimum deposit of $10,000. In exchange, you get spreads starting from 0.0 pips and an even lower commission. The commission drops to $2.50 per side for forex and metals.

Dynamic Leverage

This account also offers “dynamic leverage.” This means your buying power adjusts based on your trade size. It gives you flexibility while helping you manage risk.

Transparent Fee Structure: No Surprises

One of the biggest worries for traders is hidden costs. M4 Markets tries to remove this worry. Let’s look at their fee structure in detail.

Zero Fees on Deposits and Withdrawals

Moving money in and out of your account should be easy and free. M4 Markets does not charge you to deposit money.

They also offer free withdrawals for most methods. This is a big deal. Some brokers charge a percentage or a flat fee every time you take out your profits. At M4 Markets, what you earn is what you keep.

Fast Processing Times

Not only are transactions free, but they are also fast.

- Online payments are often instant.

- Wire transfers take 1-3 days.Waiting for your money can be stressful. Fast processing gives you peace of mind.

Swap Fees and Swap-Free Options

If you hold a trade open overnight, you usually pay a fee called a “swap.” This is an interest fee. Sometimes you pay it, and sometimes you earn it.

Islamic Accounts

For traders who cannot pay or earn interest due to religious beliefs, M4 Markets offers Islamic accounts. These are 100% swap-free. This ensures that trading is accessible to everyone, regardless of their background.

Competitive Swap Rates

For standard accounts, M4 Markets keeps swap rates competitive. They work with top liquidity providers to ensure you get fair rates.

Advanced Platforms That Save You Money

The software you use to trade can also impact your costs. A slow platform can lead to “slippage.”

What is Slippage?

Slippage happens when you click “buy” at one price, but the trade executes at a worse price. This usually happens when the market is moving fast or the platform is slow. It is a hidden cost that can hurt your results.

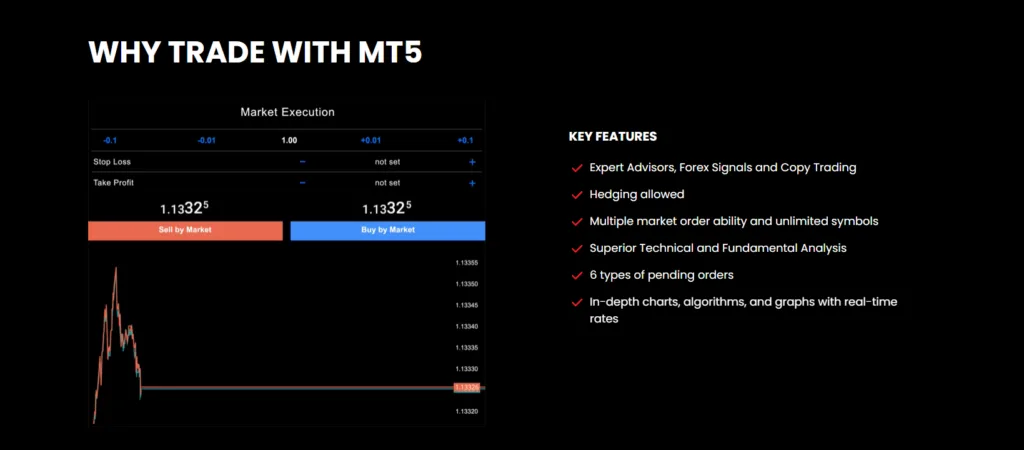

Ultra-Fast Execution with MT4 and MT5

M4 Markets uses MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These are the most popular platforms in the world for a reason.

Speed and Reliability

M4 Markets has an average execution speed of just 30 milliseconds. This is incredibly fast. It means you get the price you see on the screen. This reduces slippage and saves you money on every trade.

Powerful Tools Included

Both platforms come with free charts and indicators. You do not need to buy expensive extra software to analyze the market. Everything you need is built-in.

The cTrader Advantage

M4 Markets also offers the cTrader platform. This platform is known for its modern design and advanced features.

Smart Charting

cTrader lets you open and close trades very quickly with “QuickTrade” buttons. Speed is money in forex. Being able to react instantly helps you lock in profits before prices change.

Depth of Market

cTrader shows you the “depth of market.” This lets you see how much liquidity is available at different prices. It helps you understand if you are getting a good deal on your trade.

Conclusion: Start Keeping More of Your Profits with M4 Markets

Trading costs are a major factor in your success as a forex trader. High spreads, commissions, and hidden fees act like a leak in your bucket. They drain your profits slowly over time.

M4 Markets plugs that leak. By offering:

- Spreads starting from 0.0 pips

- Low or zero commissions

- No deposit or withdrawal fees

- Fast execution to stop slippage

They create an environment where you can thrive. Whether you are just starting with $5 or trading thousands of dollars, there is an account type that fits your needs.

If you are ready to stop overpaying for your trades, it might be time to look at M4 Markets. Keeping costs low is the first step to building a profitable trading career.

Next Steps:

- Visit the M4 Markets website to compare live spreads.

- Try a free demo account to test their execution speed.

- Start with a small deposit to see the low costs for yourself.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.

FOLLOW US