By Zahari Rangelov, Head of Business Development at TraderFactor

In the world of Forex, trust is the currency we trade in. As the Head of Sales at TraderFactor, my job involves building bridges between traders and brokers. We vet partners rigorously, ensuring they have the regulation, reputation, and infrastructure to support the clients we introduce.

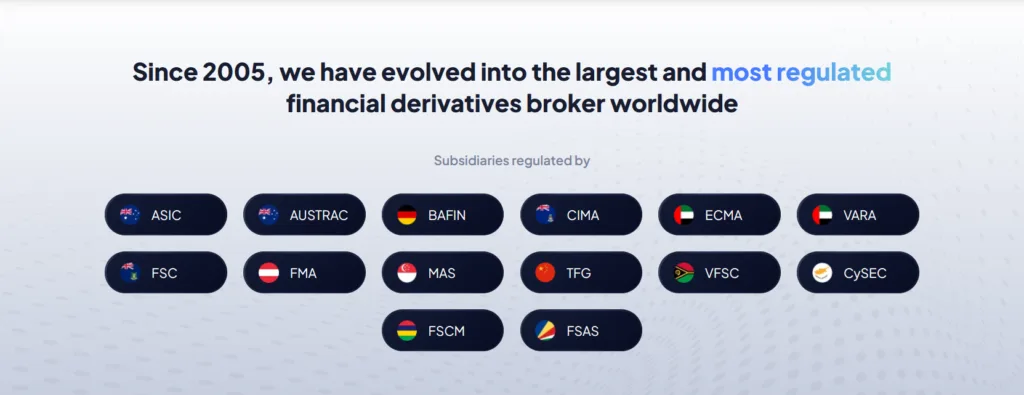

When we signed an Introducing Broker (IB) agreement with MultiBank Group, we thought we were partnering with a giant. They boast regulation by over 17 bodies worldwide. They project an image of unshakeable stability.

I never imagined that months later, I would be sitting at my desk, staring at an email that essentially accused us of criminal behavior simply because we asked to be paid for our work. MultiBank Forex Broker Scam.

This is the story of how TraderFactor was allegedly scammed by one of the most regulated brokers in the world. It is a warning to every affiliate, IB, and partner out there: regulation does not always equal integrity.

The Agreement: Simple Promises, Complex Betrayal

Our relationship with MultiBank Group started like any standard IB partnership. The premise was simple. I, representing TraderFactor, signed an agreement to introduce traders to MEX Atlantic Corporation (a MultiBank entity).

The terms were clear:

“IB shall refer/introduce Customers to MEX Atlantic Corporation for the purpose of enabling the Customers to trade the Products on the platforms of MEX Atlantic Corporation.”

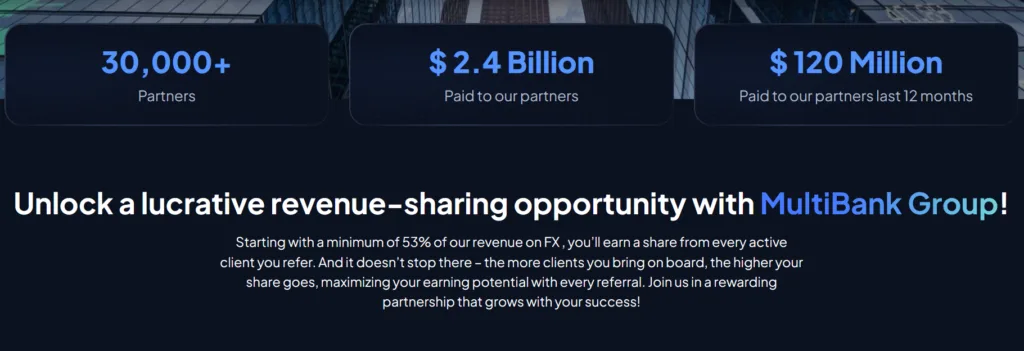

In exchange for this service, MultiBank agreed to remunerate us. We introduce clients, the clients trade, and the broker shares a portion of the spread revenue with us. This is the bedrock of the affiliate industry. It is a performance-based model. If we don’t bring active traders, we don’t get paid.

We trusted them. Why wouldn’t we? Their credentials seemed impeccable. We shook hands virtually and got to work.

The Grind: Building the Funnel

Marketing isn’t magic; it is a grind. At TraderFactor, we don’t use bots or shady tactics. We build value. For months, our team poured effort into promoting MultiBank Group.

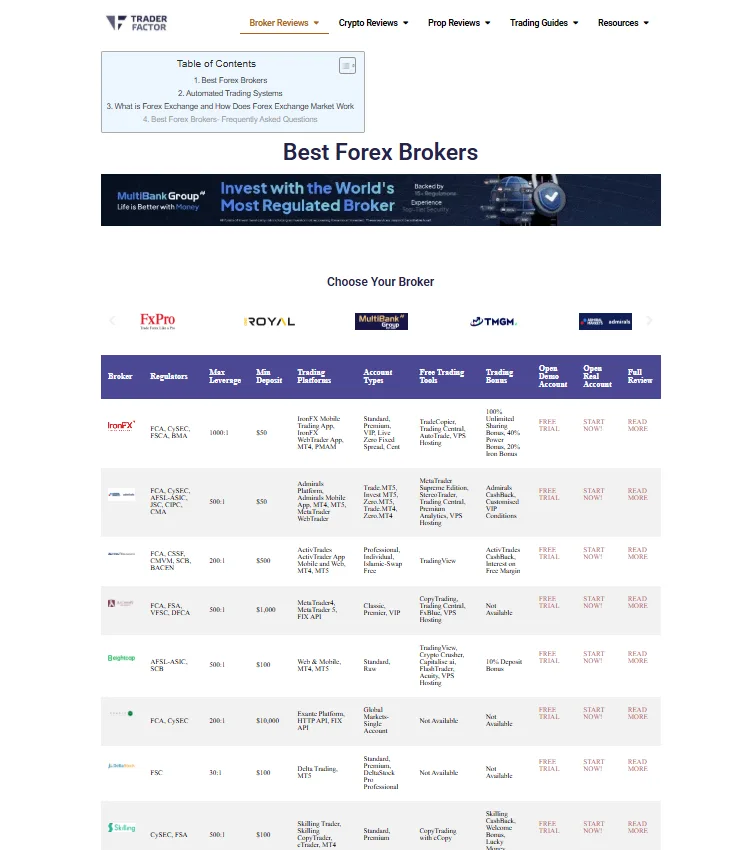

We launched comprehensive advertising campaigns on TraderFactor.com. We wrote full, honest reviews of the MultiBank platform. We published articles across financial blogs and platforms to increase their visibility. We ran digital banner campaigns and pushed social media posts across all our channels.

We were acting as a true extension of their marketing arm.

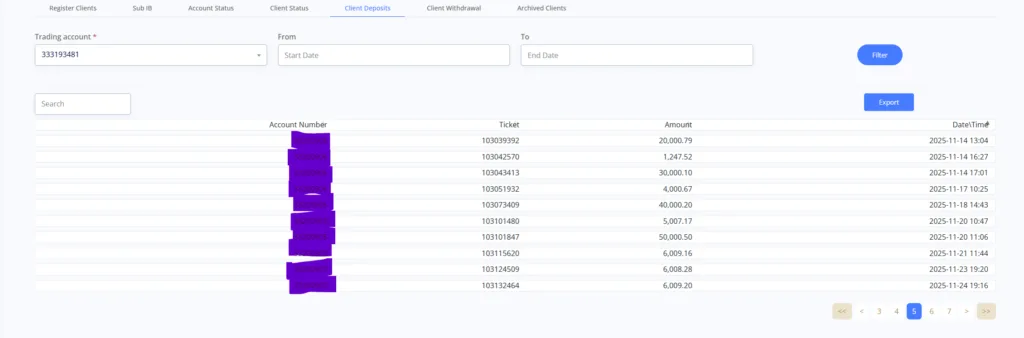

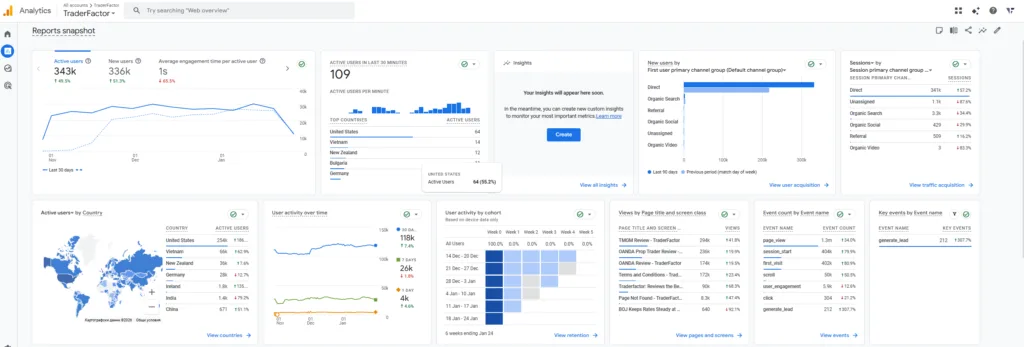

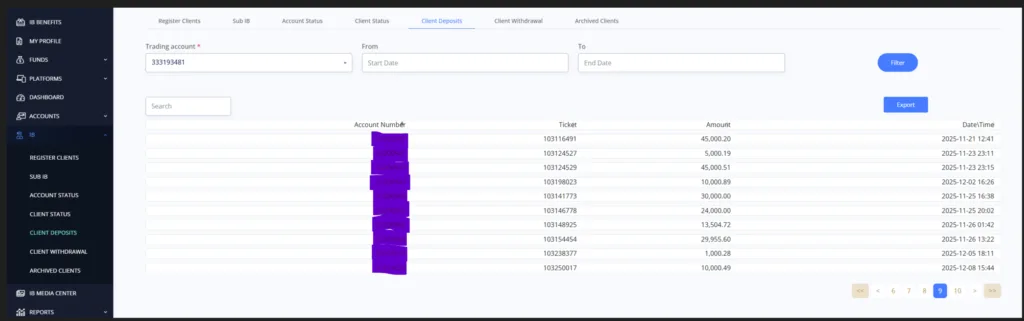

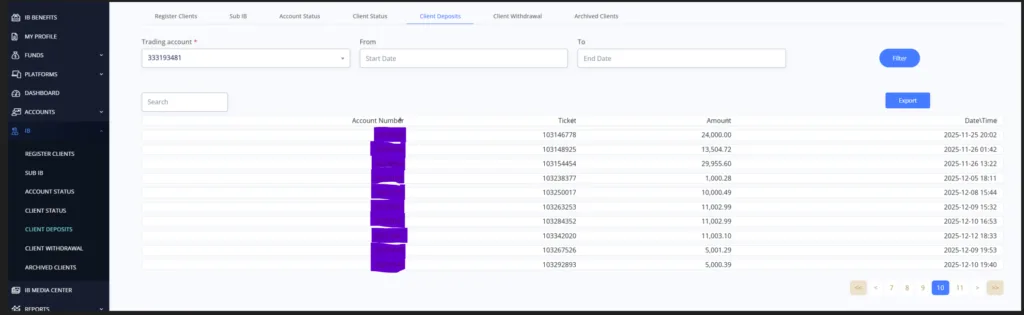

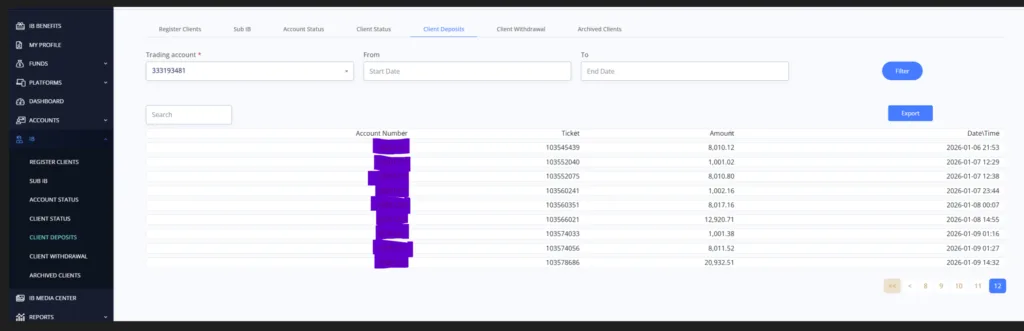

And it worked. The traffic we drove was high-quality. Traders began registering live accounts through our unique tracking links. The results were frankly amazing. We brought in more than 60 registered traders, generating overall deposits exceeding $1.2 million USD.

These weren’t small numbers. We had delivered exactly what an IB is supposed to deliver: high-value clients and significant liquidity.

The “Crime”: Asking for Our Money

According to our agreement, an IB can withdraw rebates at any given moment. However, at TraderFactor, we operate on a structured financial cycle. We decided to request a withdrawal at the end of the month, aligning with our finance team’s calculation of EBITDA and ROI.

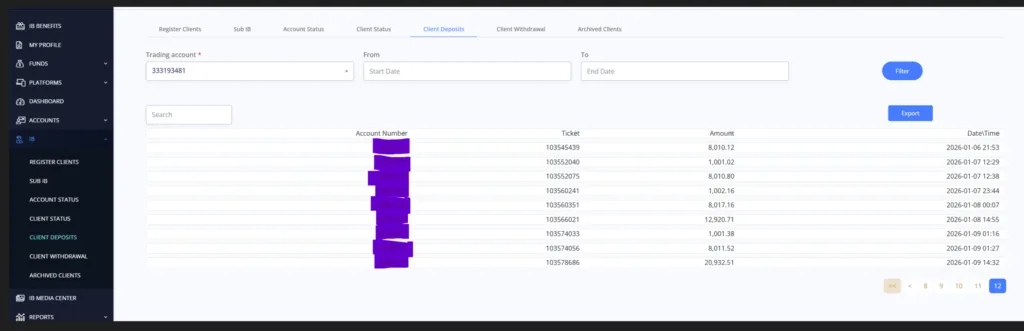

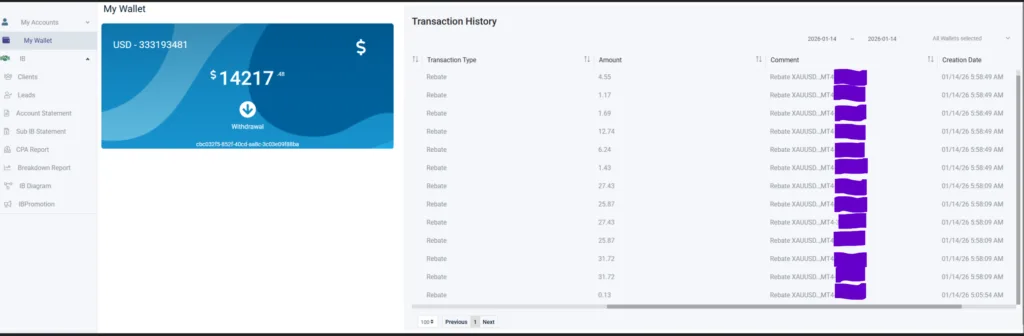

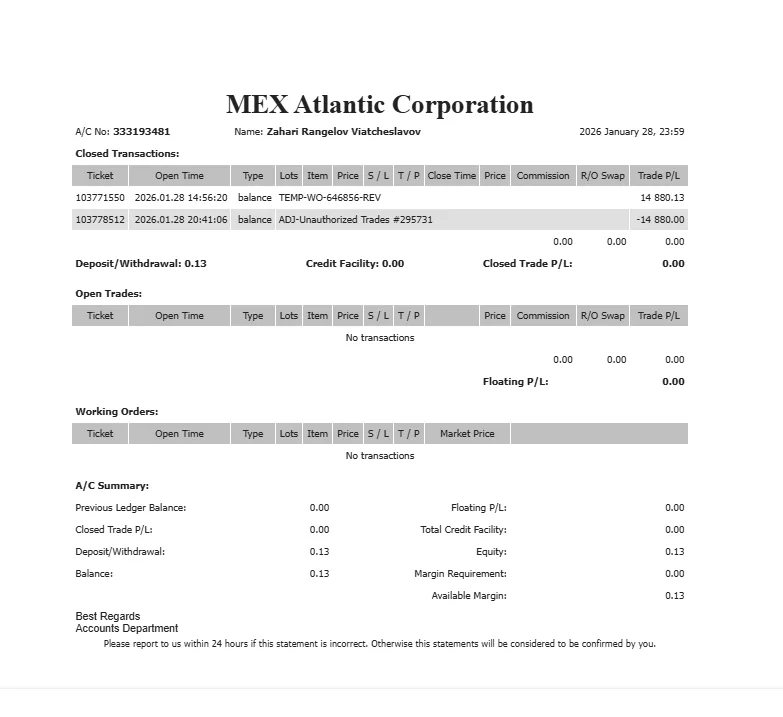

We logged into the online IB zone. We saw our earned rebates: $14,880. This was the fruit of months of labor, content creation, and SEO strategy. We clicked “withdraw.”

We expected a confirmation email. Maybe a “thank you for your business.”

Instead, a week later, I received an email from MultiBank’s legal department that made my blood run cold.

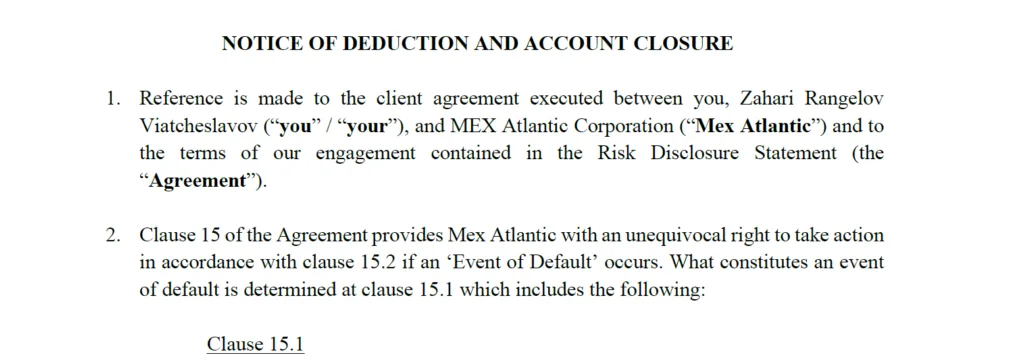

Attached was a document titled NOTICE OF DEDUCTION AND ACCOUNT CLOSURE.

The Accusation

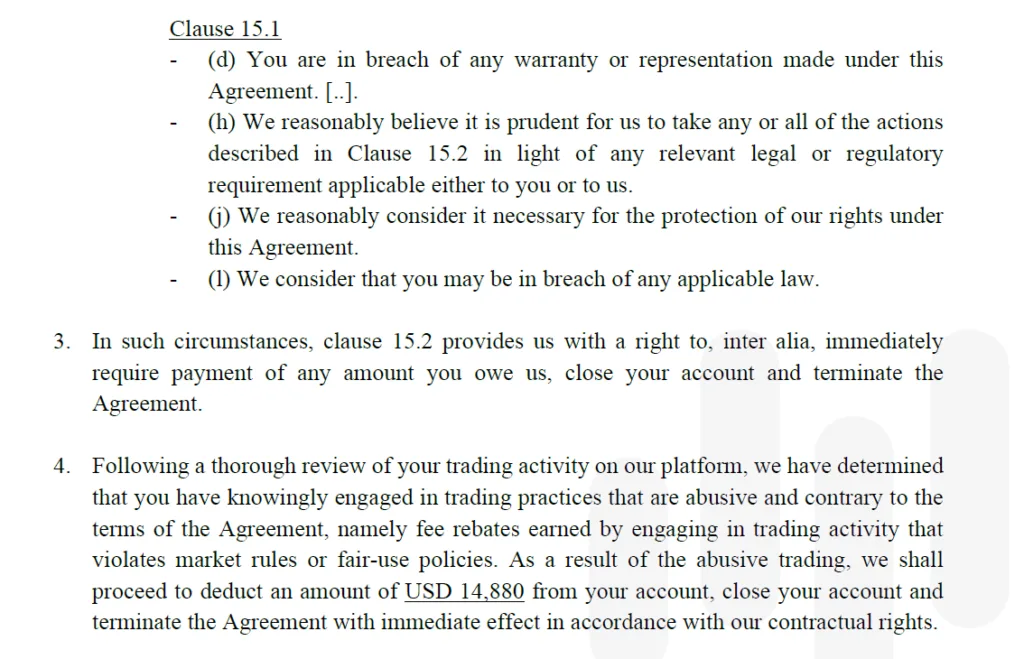

The notice was a masterclass in legal gaslighting. They referenced Clause 15 of our agreement, claiming an “Event of Default.” They threw a laundry list of clauses at us—15.1 (d), (h), (j), and (l)—claiming breach of warranty, need for protection of rights, and breach of applicable law.

But paragraph 4 was the kicker:

“Following a thorough review of your trading activity on our platform, we have determined that you have knowingly engaged in trading practices that are abusive and contrary to the terms of the Agreement, namely fee rebates earned by engaging in trading activity that violates market rules or fair-use policies. As a result of the abusive trading, we shall proceed to deduct an amount of USD 14,880 from your account, close your account and terminate the Agreement with immediate effect…”

I read it twice. “Abusive trading practices”? “Violating market rules”?

We are a marketing agency. We run a website. We don’t trade the accounts ourselves. We don’t manage money. We send traffic to their landing pages, where their compliance team approves the accounts. How could our digital banners and blog posts constitute “abusive trading”?

The Reality: Legitimate Marketing vs. The Narrative

We were baffled. Usually, when a broker accuses an IB of “rebate abuse,” they refer to high-frequency churning strategies designed solely to generate commissions without real trading intent.

But we had evidence of exactly how we generated those clients. We immediately replied to the legal department. We didn’t just send a denial; we sent proof.

We provided links to the publications on TraderFactor. We showed them the call-to-action buttons, the broker comparison tables, and the reviews.

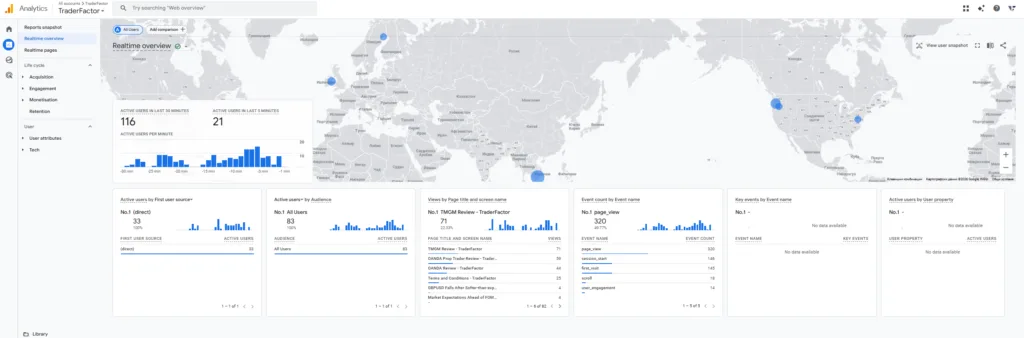

Our marketing department prepared screenshots of Google Analytics, clearly visualizing our traffic sources. We showed them that visitors came from all over the world, organic and genuine, resulting in millions of page views.

We asked a simple question: How can direct and organic traffic from a news and education website be considered “market manipulation”?

We received silence.

Since receiving that notice on January 28, 2026, I have sent multiple follow-up emails. I have asked for clarification. I have asked for evidence of this so-called abuse.

I have received zero replies from the legal team.

The Stonewall: “Zero Tolerance” for Questions

Desperate for answers, I contacted my IB Manager, Aristos Panteli. Surely, a relationship manager would bridge the gap between a misunderstanding legal team and a top-performing partner.

I forwarded him the notice. I explained our marketing methods. I expected him to say, “Let me check on this, Zahari. It must be a mistake.”

Instead, his reply was cold, dismissive, and frankly, shocking.

“This is what happens when you violate the T&C of the agreement,” he wrote. “Nothing can be done. Your IB has been terminated and you can no longer do business with Multibank.”

When I pressed further, trying to explain that legitimate marketing cannot be a violation of T&C, he shut me down with a tone that bordered on threatening.

“Let me be absolutely clear,” Aristos replied. “There is ZERO tolerance at MultiBank for rebate abuse… These matters are not subjective, not negotiable, and not handled at relationship level.”

He continued:

“Any attempt to issue threats, intimidation, or public defamation will be treated accordingly and escalated immediately to the appropriate legal channels. MultiBank does not operate under pressure, and it does not respond to coercion.”

He ended the conversation with three words: “This discussion is closed.”

The Aftermath: Silence and Stolen Rebates

And just like that, it was over.

They didn’t just close the account. They wiped the balance.

We are left with $1.2 million of our clients’ money sitting in MultiBank accounts. We have no information on what happened to those traders. Were their accounts closed too? Were they accused of abuse because they clicked a banner on TraderFactor? Or is MultiBank happily profiting from the clients we brought them, while refusing to pay the introducer fee?

The latter seems the most likely scenario. It appears to be a convenient way to boost the bottom line: let the partner do the heavy lifting, bring in the deposits, and then find a clause to void the payout.

A Warning to the Industry – MultiBank Forex Broker Scam

All of us at TraderFactor are left wondering how we could get scammed by one of the most regulated brokers in the world. Perhaps this is their business model. Perhaps “regulation” is just a shield they use to deflect accountability while they bully partners with legal threats.

If you are an IB, an affiliate, or a partner considering MultiBank Group, look at our story.

- We brought them 60+ traders.

- We brought them $1.2 million in deposits.

- We operated transparently with standard digital marketing.

- We were accused of “abuse” without evidence.

- We were stripped of $14,880 in earnings.

They told us they “do not respond to coercion.” I am not coercing anyone. I am simply telling the truth about what happened to me, Zahari Rangelov and TraderFactor.

If they can do this to a partner who brought in over a million dollars, what will they do to you?

Conclusion: What You Need to Know

My experience with MultiBank Group shows that even highly regulated brokers can act against the interests of their partners without clear justification. Despite transparent marketing efforts and fulfilling all contractual obligations, TraderFactor lost over $14,000 in earned rebates, communication was cut off, and questions about our clients remain unanswered.

If you are considering working with MultiBank Group or have encountered similar issues, I urge you to think carefully, do your research, and connect with others in the industry. Please share your own experiences in the comments or reach out if you have information or concerns about MultiBank’s practices. Your insights might help others avoid similar pitfalls and contribute to a fairer, more transparent trading community.

To our valued TraderFactor clients: We understand the seriousness of this situation and the uncertainty it may cause. Rest assured, we are committed to transparency and will keep you informed about any developments or future actions we take regarding this matter. Your trust is important to us, and we will do everything possible to protect your interests.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.

FOLLOW US