How Do I Calculate My Lot Size in Forex? Did you know that nearly 96% of new Forex traders lose their entire investment within the first six months?. Whether you’re new to trading or a seasoned pro, getting this part right is crucial for managing risks and maximizing gains. Lot size isn’t just about numbers; it’s the foundation of forex trading.

Hence, understanding this element of Forex trading can significantly decrease your potential risk, and it’s not as complicated as you might think. So, how do you determine the right lot size for your trades?

In this discussion, we’ll break down the process of calculating lot sizes in forex trading. We’ll make it easy to understand, giving you practical tips to make smart decisions that suit your trading style and risk tolerance.

Keep on reading.

Basic Terminology in Forex Trading

Before you can start calculating lot size in Forex, you need to be familiar with the basic terms used in this field. Let’s take a moment to clarify some key Forex terminology. Understanding these terms will make your trading journey easier and more effective.

First, ‘Currency Pairs’ refers to the two currencies involved in a Forex trade. The first one, known as the base currency, is the one you’re buying or selling while the second, the quote currency, is the one you’re using to buy or sell the base currency.

On the other hand, ‘Trading Platforms’ are software applications where you execute your trades. They provide real-time price quotes and charting tools, helping you make informed decisions.

Then, ‘Trading Platforms’ are software where trades occur. Choose one that suits your trading style and experience.

Other important terms include ‘Pip’, the smallest price move a currency pair can make, and ‘Leverage’, which allows you to control larger positions with a smaller amount of money.

‘Margin’ is the money required to open a leveraged position. Understanding these terms will enhance your trading experience.

Understanding Forex Lot Size

Often, you’ll find that understanding Forex lot size is necessary for successful trading, as it affects the risk you’re willing to take. Imagine it as the number of currency units you’re trading in a Forex deal. The larger your lot size, the more exposed you are to market fluctuations, translating into higher potential profits or losses.

As you delve deeper into trading, you’ll notice the impact of currency pairs on the Forex market dynamics. The exchange rate between two currencies can drastically change your trading outcome. For instance, if you’re trading a large lot size in a volatile currency pair, you could experience significant profit or loss based on minor price movements.

The Forex market is a dynamic beast, constantly reacting to economic news, geopolitical events, and market sentiment. Understanding how currency pairs impact these dynamics is essential. You’ve got to be on your toes, ready to adjust your lot size according to market volatility.

Importance of Lot Size in Trading

Now that you’ve grasped how currency pairs impact your trading outcomes, let’s explore why the lot size is so important in trading. The Lot Size Significance can’t be overstated. It influences the level of risk you’re exposed to and ultimately, your potential profits or losses.

Choosing the right lot size is integral to Trading Efficiency. A larger lot size increases your potential profit, but it also raises the risk. Conversely, a smaller lot size reduces both your potential profit and risk. Therefore, you need to find a balance that suits your risk tolerance and trading strategy.

Neglecting to understand the importance of lot size can lead to devastating consequences. Suppose you’re overzealous and opt for a large lot size without the necessary capital. In that case, you can quickly deplete your account when the market moves against you.

Step-by-Step Lot Size Calculation

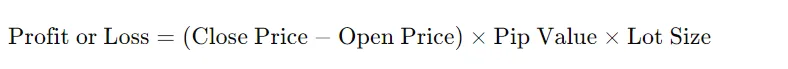

Let’s jump straight into the process of calculating lot size in Forex trading. Understanding this concept and its impact on your trades. Lot size directly influences your risk level and potential profit or loss. So it’s something you should always get right.

First, determine your risk tolerance. This is the amount of money you’re comfortable potentially losing per trade. The rule of thumb is not to risk more than 1-2% of your account balance.

Next, calculate the stop loss in pips. This is the difference between your entry price and stop loss price. The significance of pip value in this calculation can’t be overstated.

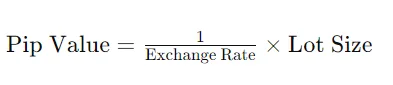

Then, compute the pip value. In most cases, a pip is the smallest change in a currency pair’s exchange rate. To find the pip value in terms of your account currency, divide one pip in decimal form (usually 0.0001) by the exchange rate of the quote currency to your account currency.

Tips for Effective Lot Size Management

Now, let’s move on to some handy tips for managing your lot size effectively and how to implement risk management strategies. By mastering these, you’ll be going a long way towards secure and profitable trading.

Managing Forex Lot Sizes

In forex trading, understanding and managing lot sizes effectively can significantly impact your success. Lot size variations are the different amounts of currency you can trade in the forex market. Forex margins, on the other hand, are like a good faith deposit to maintain open positions. This margin balance is constantly updated with unrealized gains or losses. Here’s a quick table to break it down:

| Lot Size Variations | Forex Margins Explained | |

| Micro | 1,000 units | Small deposit required |

| Mini | 10,000 units | Moderate deposit |

| Standard | 100,000 units | Largest deposit |

Knowing your lot sizes and margins helps you manage risk. You’re less likely to overextend your account or take on more risk than you’re comfortable with. So, grasp these concepts and trade wisely.

Implementing Risk Management

It’s also necessary to have a solid risk management strategy in place to effectively manage your lot sizes. This includes understanding risk mitigation and developing a coherent trading strategy.

Risk mitigation involves managing your potential losses. Don’t risk more than you can afford to lose. It’s also essential to set stop-loss orders to limit potential losses. This way, you’re not constantly watching the market, which can lead to emotional decisions.

Your trading strategy should be consistent and fit your risk profile. Don’t abruptly change your lot size based on a hunch. Instead, adjust gradually based on market trends. This approach helps maintain balance in your trading account and reduces the chance of significant losses.

Common Mistakes in Lot Size Calculation

Even experienced traders often make mistakes when calculating lot size, which can significantly impact forex profitability and risk management. One of the most common lot misconceptions is thinking bigger is always better. You might be tempted to trade larger lots, hoping for larger profits, but this can quickly lead to significant losses.

Another common mistake is ignoring the risk-reward ratio. You shouldn’t just focus on potential profits, but also consider the potential losses. If you’re risking too much for a small potential gain, you’re setting yourself up for failure.

Overtrading is another pitfall you need to avoid. Overtrading risks are real and can quickly erode your trading capital. It’s easy to fall into the trap of making numerous trades in a short time, especially when the market is volatile. However, this can lead to poor decision-making and increased risk.

Lastly, don’t ignore the market conditions. Market volatility can significantly affect the appropriate lot size. If the market is highly volatile, it might be wise to trade smaller lot sizes to limit potential losses. Remember, successful trading isn’t just about making profits, but also about effective risk management.

Frequently Asked Questions

What Is the Risk Associated With Trading in Large Forex Lot Sizes?

Trading in large forex lot sizes increases your risk due to market volatility. If you misuse leverage, you’re vulnerable to larger losses. It’s crucial to manage your risk to maintain your trading account’s health.

How Does a Change in the Exchange Rate Affect My Lot Size in Forex Trading?

When exchange volatility occurs, rate fluctuations can impact your lot size in forex trading. A rising exchange rate might decrease your lot size, while a falling rate could increase it. It’s a dynamic process.

Is There a Minimum or Maximum Lot Size in Forex Trading?

Yes, there’s variability in lot size in forex trading. However, there’s also restrictions. Typically, the minimum lot size is 0.01 (micro) and the maximum depends on the broker’s policy and your account equity.

Are There Specific Strategies for Choosing the Right Lot Size in Forex Trading?

Yes, there are strategies for choosing the right lot size in Forex trading. You’ll want to consider lot size variations and Forex diversification to mitigate risk and increase potential profits. It’s all about balance.

How Does Lot Size Impact the Profitability in Forex Trading?

Lot size directly affects your profitability metrics in forex trading. A larger lot size increases potential profits but also risks. It’ll also raise your trading volume, which can impact the market’s perception of the currency’s value.

Conclusion

In conclusion, understanding your Forex lot size is a must to trading successfully. Grasping the key terms and correctly calculating your lot size can save you from considerable losses. Avoid common mistakes and employ effective lot size management tactics. Remember, it’s not just about the trades you make, but also how much you’re willing to risk.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.

FOLLOW US