As a forex trader, you’re constantly dealing with these pips, the petite seeds of your potential wealth. It’s the smallest unit of price movement in foreign exchange trading and grows to have a significant impact on your profits. Yet, many traders overlook the importance of fully understanding these crucial components of the forex market. Understanding the concept of profit is essential for every trader seeking success in the market. One fundamental aspect of gauging profitability in Forex trading revolves around the measurement unit known as pips.

Hence, understanding profit in terms of pips not only provides traders with a standardized method of measurement but also offers valuable insights into the intricacies of Forex markets and the potential profitability of trading strategies.

Isn’t it time you explore the use of pips in forex profit?

Defining Pips in Forex Trading

In Forex trading, you’ll often hear the term ‘pips’, a crucial concept to grasp for understanding profit and loss in your trades. ‘Pip’ stands for ‘point in percentage’, and it’s essentially the smallest value by which a currency quote can change. Usually, most major currency pairs are priced to four decimal places, so a pip is a change in the last decimal point.

Now, let’s dive into ‘Pip Variations’. Not all currency pairs have the same pip value. The standard pip value for a USD-based pair like USD/CAD is $0.0001 for a micro lot. But if you’re trading a pair like EUR/JPY, the pip value can change. Calculating these variations is important to understand your potential profit or loss.

Similarly, ‘Pip Spreads’ play a vital role in Forex trading. The spread is the difference between the buy and sell price of a currency pair, measured in pips. Brokers use spreads to make money, so you’ll want to find a broker with competitive spreads. Remember, the smaller the spread, the less you’ll have to overcome in profit to break even or make money.

Building on your understanding of pips in forex, it’s crucial to grasp their importance in Forex trading as these tiny fluctuations can significantly impact your profitability. As the smallest change a price pair can make, pip fluctuations can either make or break your trading game.

Here’s why pips matter so significantly:

- Pip Fluctuations: These are what make Forex trading possible. You’re betting on these tiny changes in currency value. Pip fluctuations can be your best friend when they’re in your favor, or your worst enemy when they’re not.

- Predicting Fluctuations: If you can accurately predict pip fluctuations, you’ll be in a strong position to profit. It’s all about buying low and selling high.

- Risk Management: Pip fluctuations also help in assessing risk. By understanding potential pip changes, you can set stop-loss and take-profit levels effectively.

- Pip Spread: This is the difference between the bid and the ask price. It’s how Forex brokers make their money. The lower the spread, the less you have to overcome to start making a profit.

- Choosing a Broker: A broker with a low pip spread can make a significant difference in your profitability.

In the end, understanding and managing pips are essential to successful Forex trading.

Calculating Pips in Forex Value

Let’s dive into how to calculate pip value, a crucial step that can significantly alter your Forex trading strategy and profitability. You see, the value of a pip varies depending on the Forex pair you’re trading. Understanding this Pip Variation Impact is essential in making accurate Forex Pip Predictions.

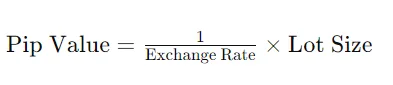

To calculate the pips in forex value, you’ll usually divide one pip (0.0001 for most currency pairs) by the exchange rate. Then, multiply the result by the lot size.

Here’s a simple table to illustrate:

| Forex Pair | Pip Value (per lot) |

| EUR/USD | 10 USD |

| USD/JPY | 1000 JPY |

| GBP/USD | 10 USD |

| USD/CHF | 10 CHF |

| EUR/GBP | 10 GBP |

This table represents pip values for different Forex pairs per standard lot (100,000 units).

Understanding Forex Profit and Loss

Now, let’s move on to understanding Forex profit and loss.

It’s essential to know how to calculate your pips in Forex profit and comprehend the nature of Forex loss.

Additionally, understanding the value of pips in Forex will give you a clearer picture of your financial gains or losses.

Calculating Forex Profit

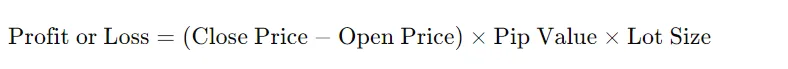

Profit margin exploration involves understanding the financial dynamics between the selling price and the cost of the traded currency pairs. It’s crucial to know how much profit you’re making on each trade relative to the costs involved.

To calculate your Forex profit accurately, you need to follow a systematic approach:

Exploring Forex Scalping Techniques

Forex scalping involves making numerous small trades to accumulate profits over short time frames. Here are some key aspects of effective scalping techniques:

By following these steps, you can accurately assess your Forex profit or loss and manage your trading activities more effectively. It’s essential to understand the concepts of profit margin exploration, employ effective scalping techniques, and use proper calculation methods to succeed in Forex trading. Additionally, risk management should always be a priority to mitigate potential losses.

Practical Examples of Pips in forex and Profit

Let’s dive right into some real-world examples to better grasp how pips and profit work in forex trading.

Suppose you’ve bought EUR/USD at 1.1250 and it moves up to 1.1270. That’s a 20 pip increase. If you’re trading one standard lot, which is 100,000 units, each pip is worth $10. So your profit would be $200 (20 pips x $10).

Pips in forex fluctuation impact comes into play here. If the rate had dropped to 1.1230, that’s a 20 pip decrease, leading to a $200 loss. Understanding the pip fluctuation impact can help you manage your trading risk.

Now, let’s consider pip strategy optimization. If you’d set a stop loss at 1.1240 and a take profit at 1.1260, you’d have limited your potential loss to 10 pips and secured a potential profit of 10 pips. That’s a 1:1 risk/reward ratio, which is a key aspect of pip strategy optimization.

Understanding Forex Loss

Just as you calculate profit in Forex trading, understanding potential losses is equally important for a balanced trading strategy. Losses can have a significant psychological impact, potentially affecting your ability to make rational decisions. Implementing loss mitigation strategies, such as stop-loss orders, can help manage these risks.

| Forex Trading Factor | Potential Profit | Potential Loss |

| Price Increase | Gain | None |

| Price Decrease | None | Loss |

| Stop-Loss Order | Limits Gain | Caps Loss |

| No Strategy | Unlimited Gain | Unbounded Loss |

You’ll notice that without a strategy, losses can be unlimited. This highlights the importance of loss mitigation strategies. Remember, it’s not just about making profits, but also about limiting losses to sustain your trading activity.

Pips Value in Forex

Often, you’ll hear traders talk about ‘pips’ – a critical concept that you’ll need to grasp to accurately calculate your profits and losses in Forex trading. Understanding the value of pips in Forex is fundamental.

You’ll find that pip fluctuations impact your trading performance. Consider Pip’s role in strategy, which is;

- Crucial in determining entry and exit points.

- Helps in setting stop-loss and take-profit levels.

- Assists in managing risks and rewards.

Tips for Using Pips in forex Effectively

Harnessing the power of pips in forex trading can significantly enhance your profit margins if you follow a few key tips.

To use pips effectively, consider the following:

To use pips effectively, consider the following:

Pip Strategy Optimization

- This is all about adjusting your trading strategy according to pip movements.

- Be flexible and adjust your trading plan based on pip fluctuations.

- Analyze historical pip movements to predict future trends.

- Use technical analysis tools to identify pip patterns and make informed decisions.

Pip based Risk Management

- This involves controlling potential losses by determining the number of pips you’re willing to risk on each trade.

- Decide your stop-loss orders in pips.

- Use a risk-reward ratio to determine how many pips are worth risking for potential gain.

- Regularly evaluate your risk tolerance in pips to maintain a balanced portfolio.

Regular Practice: Despite having a good strategy, practice is key to success.

- Use demo accounts to practice pip strategy optimization and risk management.

- Evaluate your progress regularly and make necessary adjustments.

- Patience and consistency are crucial to mastering the art of using pips effectively.

Conclusion

Understanding pips is fundamental in forex trading. They’re the measure of your profit or loss. Knowing how to calculate pip value helps you manage risk effectively. By linking pips to your profit and loss, you’re better equipped to make informed trading decisions. Remember, practice makes perfect – the more you trade, the more proficient you’ll become at using pips effectively. So, keep sharpening your skills for successful trading!

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.

FOLLOW US