Understanding how to read and use pips on XAUUSD can make a big difference in how well your trading goes. It’s like having a secret weapon for understanding how gold trading works in the forex market.

This comprehensive guide aims to demystify the concept of reading pips in the context of XAUUSD, empowering you to make informed decisions and harness the potential for substantial gains in gold trading.

From unravelling the significance of reading pips to deciphering their implications on your trading outcomes, this article serves as your definitive roadmap to navigating the complexities of XAUUSD pips with confidence and expertise.

Reading Pips on XAUUSD

- Understand the Pip Value: (What is a pip?)

- Calculate the Pip Value: (Depends on the size of your trade)

- Determine the Number of Pips: (Deduct entry price from exit price and multiply by 10,000 or divide by 0.01)

What Is XAUUSD

Diving into the world of Forex, you’ll often encounter XAUUSD, a symbol representing the price of one ounce of gold in terms of the US dollar. XAUUSD is a spot commodity pair based on the physical exchange of gold. It’s a popular asset among traders due to gold value fluctuations, which can offer exciting opportunities for profit.

Here’s a little table to better illustrate the concept:

| XAU | USD | |

| Gold | US Dollar | |

| Represents one ounce of gold | Represents the value of gold in USD | |

| Subject to gold value fluctuations | Stable and used as benchmark |

XAUUSD trading benefits include hedging against inflation, diversifying your portfolio, and the potential for significant profits if gold prices rise. It’s also a great way to get involved in the gold market without having to physically own or store the metal. Pay close attention to the pips, as they are crucial in determining your potential profit or loss. As you delve deeper into Forex trading, understanding XAUUSD becomes invaluable.

Defining Pips in Forex

Now that you’re familiar with XAUUSD, it’s crucial to grasp the concept of reading pips in Forex trading. This Forex terminology is a fundamental aspect of your trading journey. A pip, an acronym for “point in percentage,” is a unit of measure to express the change in value between two currencies. It’s the smallest price move that a currency pair can make.

When trading XAUUSD, for example, you’re dealing with gold prices in US dollars.

If the price changes from $2580.10 to $2580.20, that’s a move of 10 pips.

If you’re trading large volumes, even a small pip move can result in substantial profit or loss.

Understanding pips helps you calculate your potential earnings or losses and make strategic trading decisions. It’s all about knowing how much you stand to gain or lose for every pip movement.

For a standard lot (100 ounces), one pip is usually worth $1.

For a mini lot (10 ounces), one pip is worth $0.10, and for a micro lot (1 ounce), one pip is worth $0.01.

How to Calculate Gold Pips

To keep things simple, here is a chart to illustrate xau/usd how to calculate pips on gold:

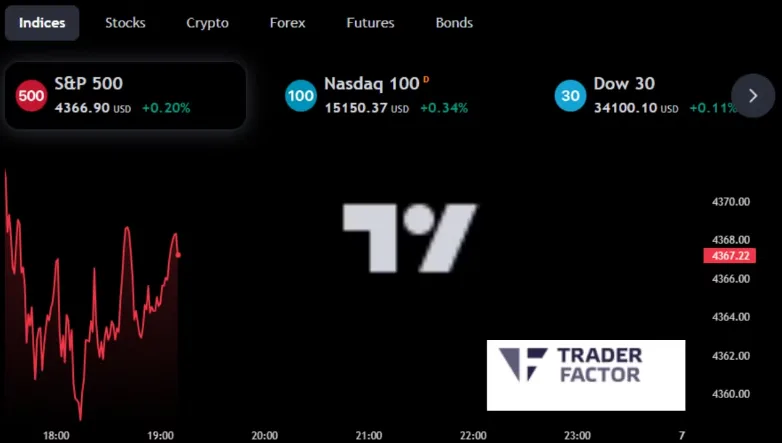

Illustration Using a XAUUSD Chart

In the above chart the price of gold falls from 2580.65 to 2579.10

To calculate the pip movement:

So, the price of gold has moved 155 pips.

How to Calculate Gold Pips on TradingView

To calculate gold pips on TradingView, you can follow these steps:

- Open a Gold Chart: Start by opening a chart for gold, typically represented as XAU/USD, on TradingView.

- Identify Entry and Exit Points: Determine your entry and exit points on the chart. These are the prices at which you plan to enter and exit the trade.

- Calculate the Price Difference: Subtract the entry price from the exit price to find the price difference. For example, if you enter at 2700.00 and exit at 2710.00, the price difference is 10.00.

- Convert Price Difference to Pips: In gold trading, a pip is usually the smallest price movement, which is 0.01 for XAU/USD. Therefore, multiply the price difference by 100 to convert it to pips. Using the previous example, 10.00 price difference equals 1000 pips (10.00 * 100).

- Use TradingView Tools: You can also use TradingView’s built-in tools like the ‘Long Position’ or ‘Short Position’ tool to visually measure the pip difference on the chart. These tools automatically calculate the pip difference when you set your entry and exit levels.

Importance of Pips in XAUUSD

Mastering the role of pips in XAUUSD trading isn’t just a good-to-know concept; it’s a vital tool that can significantly influence your trading success. Here’s why:

- Pip Volatility Impact: Pips play a critical role in assessing the volatility of XAUUSD. High pip movements imply greater volatility, leading to potential trading opportunities. Understanding pip volatility impact can help you strategize your trades, manage your risk and maximize your profits.

- XAUUSD Pip Trends: Observing and interpreting pip trends in XAUUSD can provide vital clues about market direction. By discerning these trends, you’ll be better equipped to make informed trading decisions, whether you’re planning to go long or short.

- Profit and Loss Calculations: Pips are essential for calculating your potential profits and losses. Each pip movement in your favor translates into profit, while movements against you result in losses. Being able to accurately calculate the value of pips can therefore directly impact your trading bottom line.

Identifying and Reading Pips on XAUUSD Chart

Diving right into the heart of our discussion, it’s crucial to learn how to pinpoint pips on a XAUUSD chart for effective trading. Identifying and reading pips on an XAU/USD chart involves understanding how price movements are measured and displayed.

Here’s a step-by-step guide to help you:

- Understand the Pip Value: In XAU/USD (gold), a pip is typically the smallest price movement, which is 0.01. This means that if the price moves from 2600.00 to 2600.01, it has moved by one pip.

- Open the XAU/USD Chart: Use a trading platform like TradingView to open the XAU/USD chart. Ensure the chart is set to a suitable time frame for your analysis (e.g., 1-hour, 4-hour).

- Identify Price Levels: Look at the price scale on the right side of the chart. Each increment of 0.01 represents one pip.

- Use Crosshair Tool: Activate the crosshair tool on your charting platform. This tool helps you precisely identify price levels and measure the distance between two points on the chart.

- Measure Pip Movement: Click and drag the crosshair from your entry point to your exit point. The tool will display the price difference, which you can convert to pips by multiplying the difference by 100 (since 1 pip = 0.01).

- Utilize Position Tools: Many platforms offer ‘Long Position’ and ‘Short Position’ tools. These tools allow you to set your entry and exit points visually and automatically calculate the pip difference, along with potential profit or loss.

- Check the Price Scale: Always double-check the price scale to ensure you’re reading the pip movements correctly, especially if the chart settings or time frames change.

Interpreting Pips Values in XAUUSD

Now that you’ve got a handle on identifying and tracking or reading pips on a XAUUSD chart, let’s explore how to interpret these pip values in the context of your trading strategy. Understanding the value of each pip is key to managing your risk and potential profit.

First, be aware of pips volatility. This refers to the frequency and extent of pip value changes in XAUUSD. High volatility means pip values fluctuate more, leading to bigger potential gains or losses. Lower volatility means less fluctuation but also steadier, more predictable returns. Depending on your risk tolerance, you may prefer one over the other.

Next, consider the pipette significance. Pipettes are fractions of a pip, and while they may seem insignificant, they can impact your profit or loss. For instance, a 0.1 pipette difference on a 100,000 unit XAUUSD trade represents a $10 change!

Understand the XAUUSD Volatility Impact

The price of gold can be extremely volatile, meaning it can change rapidly over a short period. This volatility can lead to significant gains or losses for investors, with high risk but also high profit potential.

Apply the Calculation

To determine the pip value, subtract the lower price from the higher price and multiply by the transaction size. For instance, when trading one standard lot of XAUUSD (100 ounces), a one pip movement equals $1.

Enhancing Your XAUUSD Trading Strategy

To enhance your XAUUSD trading strategy, it’s crucial to incorporate your newfound understanding of reading pips into your decision-making process. This, coupled with leveraging volatility and implementing risk management strategies, will help you navigate the forex market more effectively.

- Leveraging Volatility: Volatility is the rate at which the price of an asset increases or decreases for a set of returns. XAUUSD trading is often characterized by high volatility, and you can leverage this by timing your trades aptly. For instance, during periods of high volatility, you might decide to buy low and sell high.

- Reading Pips: A pip measures the change in a currency pair’s exchange rate. Understanding how to read pips enhances your ability to make informed trading decisions. Mastering pips can offer you a clearer picture of potential profits or losses.

- Risk Management Strategies: It’s essential to always have risk management strategies in place. This could range from setting stop-loss orders to diversifying your portfolio. Effective risk management can prevent substantial losses and increase your chances of success.

Incorporating these components into your XAUUSD trading strategy can significantly enhance your trading outcomes.

Frequently Asked Questions

How to calculate gold pips in forex?

Pips on gold, like other currency pairs, are typically measured as the smallest price change in the fourth decimal place, although in gold trading, prices are quoted with two decimal places.

How much is 1 pip in XAUUSD?

One pip in XAUUSD is usually equivalent to a movement of 0.01 in price.

How much is 0.01 lot in XAUUSD?

Trading 0.01 lot in XAUUSD typically means controlling 1 ounce of gold, with the pip value depending on the current market price.

How to read XAUUSD chart?

To read an XAUUSD chart, analyze the price movements over time, focusing on key levels of support and resistance, and use indicators to identify trends and potential entry or exit points.

How many dollars is 100 pips?

The dollar value of 100 pips in XAUUSD depends on the lot size being traded; for a standard lot, 100 pips would typically be $100.

How much is 0.01 lot size pip worth?

For a 0.01 lot size in XAUUSD, a single pip is generally worth approximately $0.10, though this can vary slightly with price fluctuations.

How much is 50 pips worth?

The worth of 50 pips in XAUUSD depends on your lot size; for a standard lot, 50 pips would be equivalent to $50.

Is 1 pip 10 dollars?

In XAUUSD, 1 pip is generally not $10; this value applies to a movement of 1 point for a standard lot size, which is 100 pips.

How to calculate pips on Gold?

To calculate pips on gold, determine the difference between two prices in the second decimal place of the XAUUSD quote.

How to read pips on XAUUSD calculator?

A pip calculator helps you determine the monetary value of pips in XAUUSD by inputting your lot size and the current market price.

How to read XAUUSD pip calculator?

Use an XAUUSD pip calculator by entering the trade size and currency pair to find out how much each pip is worth in your account currency.

How to count pips on gold TradingView?

On TradingView, count pips on gold by observing the price change between two points and noting the movement in the second decimal place.

How much is 10 pips in XAUUSD?

The value of 10 pips in gold depends on the lot size, but for a standard lot, it would typically equate to $10.

What is a gold pips profit calculator?

An XAUUSD Profit Calculator helps you calculate your expected profit or loss in money and pips for gold trading. This tool allows you to input your entry and exit prices, lot size, and trade direction to get detailed calculations.

Conclusion

Understanding pips in XAUUSD can significantly refine your trading strategy. It’s essential to get the basics right, from knowing XAUUSD and pips, to setting up your trading platform correctly. Remember, interpreting and calculating pips values with precision can make a big difference. Keep these essential tips in mind and continue honing your skills. With practice, your ability to read pips on XAUUSD and make informed trading decisions will surely improve.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.

FOLLOW US